The Year Aviation Bounced Back – And Faced New Challenges

As 2025 draws to a close, the aviation industry can look back on a year of recovery, innovation, and persistent challenges. From Boeing’s turnaround to new aircraft types entering service, from record passenger numbers to airline bankruptcies, this year had it all.

Here’s our comprehensive review of the 10 biggest stories that shaped aviation in 2025.

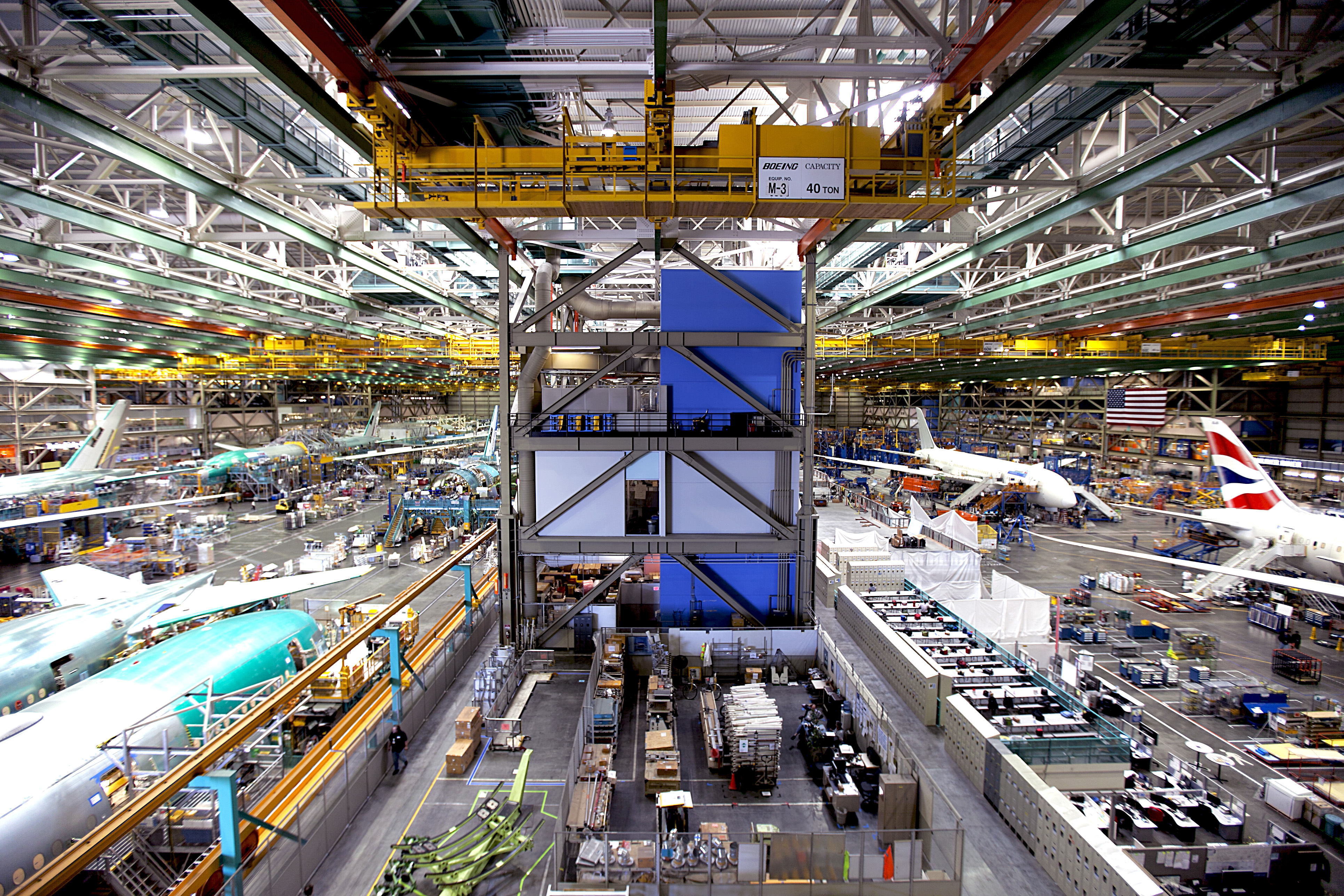

1. Boeing’s Comeback Story

If there’s a single narrative that defined 2025, it’s Boeing’s remarkable recovery from the crisis that began on January 5, 2024, when a door plug blew off an Alaska Airlines 737-9 MAX.

The journey back included:

- Spirit AeroSystems acquisition: Bringing fuselage production back in-house after years of quality issues with the supplier

- Leadership changes: New CEO Kelly Ortberg brought renewed focus on engineering and quality over financial metrics

- FAA approval: Production cap lifted to 42 aircraft monthly after demonstrating improved quality controls

- Delivery surge: 69% more aircraft delivered compared to 2024’s crisis-impacted numbers

- Flightradar24 partnership: Enhanced real-time safety data access across the global fleet

Boeing isn’t fully healed – profits remain elusive, and the 777X still awaits certification – but the trajectory is clearly positive. The company that once seemed on the brink has found its footing again.

2. The A321XLR Revolution

2025 saw the A321XLR go from promising concept to operational reality. American Airlines became the first U.S. carrier to fly the game-changing narrow-body, joining Iberia, Aer Lingus, Wizz Air, and Qantas.

What makes the A321XLR revolutionary:

- 4,700 nautical mile range: Unprecedented for a single-aisle aircraft

- New city-pairs: Opens routes between secondary cities that couldn’t support widebody service

- Premium experience: Lie-flat business class matching widebody comfort

- Economics: Lower operating costs per seat than 787s or A330s on thin routes

Routes that seemed impossible – Indianapolis to Dublin, Pittsburgh to Lisbon – are now viable. The XLR hasn’t just created a new aircraft category; it’s rewriting the transatlantic route map.

3. Airbus vs Boeing: The Final Numbers

When the dust settled on 2025, Airbus had once again outdelivered Boeing – though the gap narrowed significantly from 2024’s crisis-widened margin.

The numbers tell the story:

- Airbus: Delivered 766 aircraft, short of its 800-unit target but still dominant

- Boeing: Delivered approximately 400 aircraft, up 69% from 2024’s dismal 237

- Order battle: Both manufacturers saw strong demand, with backlogs stretching into the 2030s

- Supply chain: Neither company could ramp up as fast as airlines wanted

The duopoly remains intact, but the competitive dynamics have shifted. Airlines desperate for aircraft are taking whatever they can get from either manufacturer.

4. Record Passenger Numbers

Despite higher fares, economic uncertainty, and persistent operational challenges, people flew in record numbers throughout 2025.

The statistics were staggering:

- TSA records: Multiple single-day screening records broken during holiday periods

- Summer surge: Airlines operated at maximum capacity on popular routes

- International recovery: Transatlantic and transpacific routes finally exceeded 2019 levels

- Business travel: Corporate flying rebounded stronger than expected

The demand for air travel has proven remarkably resilient. Economic concerns, sustainability debates, and alternative transportation options haven’t dented the public’s appetite for flying. If anything, post-pandemic wanderlust seems to have become permanent.

5. Spirit Airlines: The Death of Ultra-Low-Cost?

The biggest airline story of 2025 wasn’t a success – it was Spirit Airlines filing for Chapter 11 bankruptcy in November, marking the most significant U.S. carrier failure since 2008.

How Spirit fell apart:

- JetBlue merger blocked: The DOJ’s antitrust action in early 2024 left Spirit without a lifeline

- Pratt & Whitney groundings: Engine issues hit Spirit’s all-Airbus fleet particularly hard

- Fare competition: Legacy carriers matched ultra-low-cost pricing on key routes

- Customer perception: Years of nickel-and-diming caught up with the brand

Spirit plans to emerge from bankruptcy as a smaller carrier, but the existential question remains: Is there room for ultra-low-cost carriers in America’s aviation landscape? Frontier is watching nervously.

6. The Pratt & Whitney Engine Crisis Deepens

What began as a 2023 inspection issue turned into a full-blown crisis in 2025, with Pratt & Whitney’s GTF engines grounding hundreds of aircraft worldwide.

The scope of the problem:

- Affected aircraft: A320neo family, A220, and Embraer E2 jets – over 3,000 engines in service

- Powder metal contamination: Manufacturing defects requiring accelerated inspections

- Airline impact: IndiGo, Spirit, JetBlue, and others forced to ground aircraft for months

- Compensation claims: RTX facing billions in airline claims and repair costs

Pratt & Whitney parent RTX has set aside over $7 billion to address the issue, but the reputational damage may last longer. Airlines ordering new narrowbodies are increasingly specifying CFM LEAP engines instead.

7. Chinese Airlines Dominate Europe Routes

A quieter but significant shift occurred on Europe-Asia routes in 2025: Chinese carriers now control 82% of China-Europe capacity, up from 66% pre-pandemic.

What’s driving the imbalance:

- Russian airspace: Chinese airlines can overfly Russia; European carriers cannot

- Flight time advantage: 2-4 hours shorter on most routes for Chinese carriers

- Cost advantage: Fuel savings translate to lower fares

- Capacity flooding: Chinese carriers aggressively adding frequencies

European carriers like Lufthansa, Air France, and British Airways have been forced to reduce or suspend China routes that are no longer economically viable. The geopolitical fallout from Russia’s invasion of Ukraine continues to reshape global aviation patterns in unexpected ways.

8. Finland’s F-35 Order Rewrites Arctic Air Power

In military aviation, the biggest story was Finland’s F-35 program finally becoming reality. The first Finnish F-35A rolled out in December, marking a fundamental shift in Nordic security.

Why Finland’s order matters:

- 64 aircraft: One of the largest European F-35 orders

- 830-mile border: Finland shares the longest EU border with Russia

- NATO integration: Finland joined NATO in 2023; the F-35s cement that alliance

- Arctic capability: Fifth-generation stealth over the High North

The Vermont Air National Guard also deployed F-35s to the Caribbean for the first time, demonstrating the type’s global reach. The Lightning II has become the de facto standard Western fighter.

9. Canada’s First Indigenous-Owned Airline Takes Flight

One of 2025’s most heartwarming aviation stories: Rise Air became Canada’s first Indigenous-owned commercial airline, taking delivery of its first ATR 72-600 in December.

Rise Air represents something new:

- Ownership: Majority owned by the Kikitagruk Inupiat Corporation from Alaska and Nunasi Corporation from Nunavut

- Mission: Connecting remote Indigenous communities across Canada’s North

- Fleet: Starting with ATR 72-600 turboprops suited for northern operations

- Economic impact: Creating jobs and opportunities in underserved regions

The airline plans to expand service throughout Northern Canada, areas often underserved by major carriers. It’s a reminder that aviation’s future isn’t just about bigger jets and longer routes – sometimes it’s about connecting communities that have been overlooked.

10. What’s Coming in 2026

As we look ahead, several stories will dominate 2026:

- 777X certification: Boeing’s long-delayed widebody should finally enter service

- Spirit Airlines restructuring: Will the carrier emerge or liquidate?

- Sustainable aviation fuel: Mandates take effect in Europe, forcing industry adaptation

- A350 freighter: Airbus’s first dedicated cargo aircraft enters production

- China’s C919: COMAC’s narrowbody expands beyond initial Chinese operators

The Bottom Line

2025 will be remembered as the year aviation found its footing after the turbulence of 2024. Boeing began its recovery. The A321XLR proved its promise. Passengers flew in record numbers. But Spirit’s bankruptcy and the ongoing engine crisis remind us that this industry never stays calm for long.

Challenges remain – they always do in an industry this complex. Supply chains are still strained. Pilot shortages persist. The path to sustainability remains unclear. But as we enter 2026, aviation stands on stronger ground than it did twelve months ago.

That’s progress worth celebrating – even as we buckle up for whatever turbulence comes next.

Leave a Reply